Know how to get an e-PAN Card : Instant PAN through Aadhaar?

PAN card is necessary for many financial functions such as opening a bank account, investing in mutual funds, or the stock market. Even you will not be able to transact more than Rs 50,000 without a PAN card.

If you have not yet made a PAN card and you need it urgently, there is no reason to panic. You can get a PAN card in less than 10 minutes through Aadhaar Card.

You can get your e-PAN card made online through Aadhaar Card. This facility is completely free. For this, you have to apply for a PAN card from the income tax website. You will only need to enter the 12 digit Aadhaar number to apply for e-PAN.

Keep in mind that it is necessary for the mobile number to be linked with the Aadhaar number.

This is a step by step process

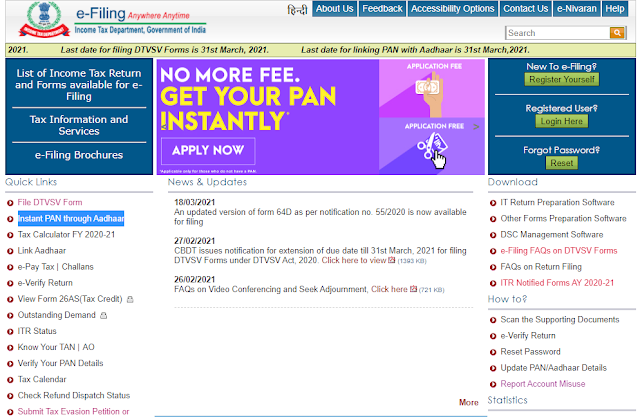

- E-filing website of Income Tax Department http://www.incometaxindiaefiling.gov.in/home.

- Now go to the 'Quick Links' section on the home page and click on 'Instant PAN through Aadhaar'.

- Then click on the link to 'Get New PAN'. This will take you to the Instant Pan Request webpage.

- Now confirm by entering your Aadhaar number and captcha code.

- Now click on Generate Aadhar OTP. You will receive an OTP on the registered mobile number.

- Enter OTP in the text box and click on Validate Aadhaar OTP. After this, click on the Continue button.

- Now you will be redirected to the PAN request submission page, here you will have to confirm your Aadhaar details and accept the terms and conditions.

- After this, click on 'Submit PAN Request.

- Now after this, an enrollment number will be generated.

- You note down this enrollment number.

The process to download PAN card

For this, you will have to go to the 'Quick Links' section on the homepage of the e-filing website of the Income Tax Department and click on 'Instant PAN through Aadhaar'. After this you click on the 'Check Status / Download PAN' button here.

Comments